how to calculate rpgt

And if the Tenancy Agreement has been signed for more than 3 years the. Hong Leong Bank eFixed Deposit-i promotion.

2022-2-8With all that said heres an example of how to calculate your net rental income.

. Said properties must be residential homes sold between 1 June 2020 to 31. Looking for the best personal loan in Malaysia. Now I can calculate my clients legal fees stamp duty easily.

Increment and Reduction in income tax. IProperty Based on the Real Property Gains Tax Act 1976 RPGT is a tax on chargeable gains derived from the disposal of property. RPGT calculation can be quite complicated and confusing when I am calculating my clients and my own investment.

Related

A chargeable gain is a profit when the disposal price is more than the purchase price of the property. LPPEH Fee section Fee for other capital valuation rating valuation services based on an Improved Value basis1. 2022-10-23A capital gains tax CGT is the tax on profits realized on the sale of a non-inventory assetThe most common capital gains are realized from the sale of stocks bonds precious metals real estate and property.

You will also need to declare whether or not you sold any taxable assets which would fall under the Real Property Gains Tax RPGT Act at this step. 14 of the first RM100000 15 of the residue up to RM2 million 16 of the residue up to RM7 million 18 of the residue up to RM15 million. Able to calculate Carry-back losses YA 2009 Calculate Section 60F deduction automatically.

Provide your income details. Easylaw solves this for me. Superior Tax Comp Superior ComSec Superior TimeCost Superior SST.

RPGT is only payable if you profit from the sale. The flat interest rate is mostly used for personal and car loans. So imagine that you are going to buy a new property at a purchase price of RM300000.

Compare and get a personal loan with interest rates as low as 25. Shopping for a car loan for your new or used car. Compare and calculate your monthly repayments on Loanstreets car loan calculator and save more than RM100 every month.

Your employer is responsible to inform IRBM within thirty 30 days before the cessation date by completing and submitting Form CP21 Notification by the Employer for Employees Who Want to Leave Malaysia to the LHDNM branch that handles your income tax file. 2 days agoProperty Valuation Fee Calculator. 2022-10-14Top 5 Performing Funds For Short Term Investment 1 month - 5 Years If youre investing for short term gain typically within 1 month to 5 years you must make sure that the fund youre investing can give a higher return than fixed deposit rate which averages around 3.

2022-4-27How to calculate RPGT and what kind of impact does it have on you. We will have to comply with every rule and regulation. Amazon Drive Cloud storage from Amazon.

Income Tax Act 1967 Schedule 3 stated clearly that the maximum qualifying expenditure for a private vehicle not licensed on a commercial basis is RM50000 RM100000 if the purchased vehicle is a new vehicle and its value is less than RM150000 this is why everybody believe register private vehicle under. Up to 350 pa. Imagine you applied for a personal loan of RM100000 at a flat interest rate of 5 pa.

2022-7-7How to calculate Memorandum of Transfer MOT. Amazon Advertising Find attract and engage customers. 6pm Score deals on fashion brands.

I can even save share the results with clients instantly. As part of PENJANA the Real Property Gains Tax RPGT will also be exempted for the disposal of properties. Income Tax Act 1967 Schedule 3 stated clearly that the maximum qualifying expenditure for a private vehicle not licensed on a commercial basis is RM50000 RM100000 if the purchased vehicle is a new vehicle and its value is less than RM150000 this is why everybody believe register private vehicle under.

IA is fixed at the rate of 20 based on the original cost of the asset at the time when the capital was obtained. Capital allowances consist of an initial allowance IA and annual allowance AA. 2021-7-30Basically the Stamp Duty for Tenancy Agreements spanning less than one year is RM1 for every RM250 of the annual rent in excess of RM2400.

Due to the MCO period Selangor land offices are having a new SOP. 2022-3-11The second step is to review a few more details about yourself. The stamp duty fee for the first RM100000 will be 1000001 RM1000.

The rates are between 5 to 30 depending on how long you have owned the property. Gross rental income Monthly rent. Amazon Music Stream millions of songs.

How to Calculate RPGT 2022. You can also declare any tax incentives you have received at this step. For contracts that are signed for anywhere between 1 to 3 years the stamp duty rate is RM2 for every RM250 of the annual rent in excess of RM2400.

Save time for me. CC BY-SA 30 Calvin Cheng and NUS Computing profile page Dr Ben Leong Over the past week in light of new record million-dollar HDB resale flats being sold and the September 30 cooling measures many have given their assessment of runaway HDB housing prices and for some how the restrictions either help improve or dampen sentiments. Payment options Reference.

Now the Government is also encouraging these foreigners to choose to make Malaysia their second home whether for long-term stay retirement or investment purposes. RPGT is tax you pay when you sell your property. 2022-4-27Real Property Gains Tax RPGT is an important property-related tax in Malaysia that applies to property sellers and many are often left confused when there are multiple updates.

Increment and Reduction in income tax. 2022-4-29Foreigners in Malaysia are either expatriates or tourists and thus have been received with warm welcomes when visiting our country. Lim32Conveyancing Lawyer PJ.

Tax Secretary MBRS RPGT Time Cost Accounting Software in Malaysia. With a tenure of 10 years. SUPERIOR IT SOLUTIONS SDN.

Calculate interest restriction automatically. Land Office Charges will be subject to the official land office charges at each state. Calculation of Stamp Duty on SPA Memorandum of Transfer and Instrument on Loan Agreement.

2022-10-25Bank. Not all countries impose a capital gains tax and most have different rates of taxation for individuals versus corporations. How to check property valuation fee in malaysia.

A flat interest rate is always a fixed percentage. We will have to increase the price for the LOCAL Selangor land search to RM30 Effective since 19th June 2020. Get approval within 24 hours.

Find a competitive interest rate for your hire-purchase from 18 banks in Malaysia. Use the personal loan calculator to check for your monthly repayments and apply online for free.

Real Property Gains Tax Rpgt Guide For The Year 2020 2021 In Malaysia

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Justletak Standard Format Rpgt Calculation

All You Need To Know About Real Property Gains Tax Rpgt

How To Calculate Rpgt In 2020 For Sale Of An Inherited Property

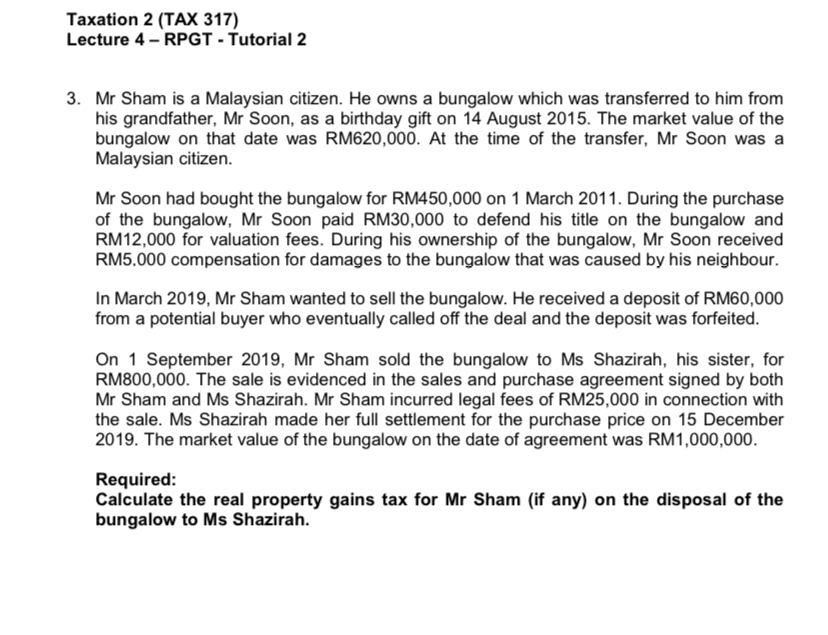

Format Of Rpgt Payable Revised Computation Of Rpgt Payable Disposal Price Para 5 Sch 2 Studocu

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

What Is Real Property Gains Tax The Star

Real Property Gains Tax Rpgt Calculation Rpgt Exemption

Solved Taxation 2 Tax 317 Lecture 4 Rpgt Tutorial 2 3 Chegg Com

What Is Rpgt Dpi Media Des Prix Infinitus Media

Rpgt For Company In Malaysia L The Definitive Guide 2022 Industrial Malaysia

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Rpgt In Malaysia A Brief History Latest Exemptions And Calculation Rpgt In Mal Aysi A A Brief Studocu

5 Vip Very Important Painful Property Taxes All Malaysians Should Know Propsocial

Rpgt In Malaysia A Brief History Latest Exemptions And Calculation Iproperty Com My

Updated 2020 All About Real Property Gains Tax Rpgt In Malaysia

What Is Real Property Gains Tax And How Does It Affect You Airmas Group

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

0 Response to "how to calculate rpgt"

Post a Comment